The Political Fix: The mirage of 20% GDP growth and India’s ‘unaddressed demand crisis’

A newsletter on politics and policy from Scroll.in.

Welcome to The Political Fix by Rohan Venkataramakrishnan, a newsletter on Indian politics and policy. To get it in your inbox every week, sign up here.

Our small team wants to cover the big issues. That is why we are appealing for contributions to our Ground Reporting Fund. If you’d like to assist our effort, click here.

The Big Story: Mirage

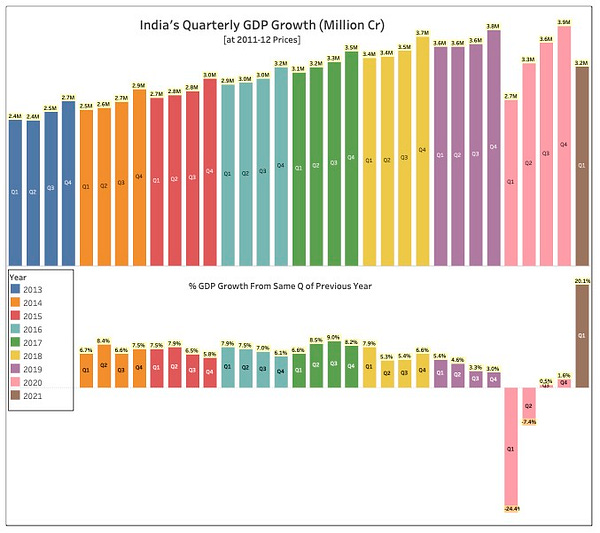

Anyone paying attention to the Indian economy knew that the Gross Domestic Product numbers coming in for the April-June 2021 quarter would not be easy to read, since they would be based on the 24.4% contraction seen in the equivalent quarter in 2020 when the country saw its first, harsh Covid lockdown.

Except, that is, for representatives of the Indian government who could be expected to parrot the old cliches – ‘the worst is over’ and ‘V-shaped recovery’ – no matter what the underlying numbers actually showed.

And indeed, that is what happened. India clocked 20.1% growth for the April-June 2021 quarter, despite that period coinciding with the devastating second wave.

But the massively positive headline number masked a tremendous amount of underlying pain.

A few figures tell the story:

The actual numbers of the April-June 2021 quarter compared to the the January-March 2021 quarter showed a 16.9% contraction, making it clear that the second wave hit the economy hard – only not as a badly as the first lockdown.

The actual numbers of April-June 2021 quarter were also 9.2% below the equivalent figures in the pre-pandemic April-June 2019 quarter, meaning the Indian economy is smaller today than it was two years ago.

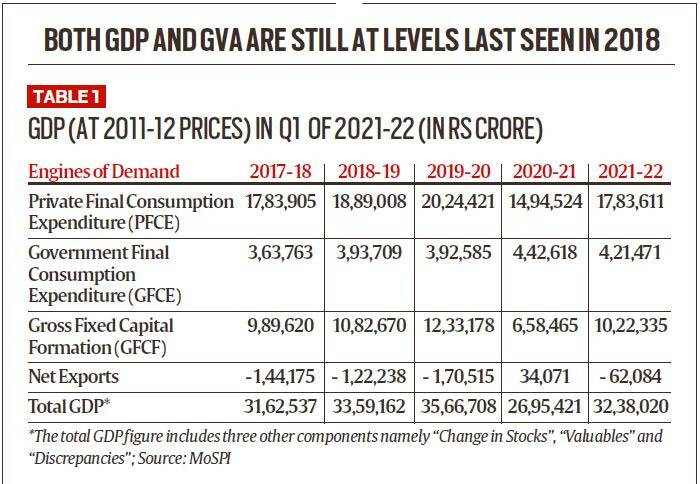

Charts from the Hindustan Times and the Indian Express sought to illustrate this point.

This means the Indian economy still has some way to go before going back to the size it had attained in 2019, and only then can think of returning to a growth path.

Details embedded within the GDP numbers reveal how difficult that may actually be, in part because of the supply-side approach that the government has taken.

From Dilasha Seth’s report:

“The government's expenditure has contracted in the first four months of the current financial year despite a surge in revenue, driven by tax collections, which may adversely impact economic growth as private investments are yet to pick up…

The government's capex declined by 39.40 per cent in July this financial year compared to the same month in the previous financial year. It was way down, by 62 per cent, compared to July 2019-20… “

Elsewhere there are other worries. Gross Value Added in construction, for example, was higher in the April-June quarter in 2017 – four years ago – than it was in 2021. The same is true for the ‘trade, hotels, transport and communication services’ category, which represents significant employment. GVA in manufacturing for the quarter was lower than it was in 2018.

Only two sectors – agriculture and electricity utilities – are above where they had been in the pre-pandemic April-June 2019 quarter. Although exports per se have done well, in line with other countries emerging much stronger this year from the Covid crisis, net trade remains negative for India because of its reliance on imports. Private investment, which tends to account for a third of India’s GDP, as 17% lower in the April-June 2021 quarter than it had been two years prior.

Which brings us to the most worrisome element. Here is TN Ninan:

“What has attracted little attention, meanwhile, is something that perhaps only the Indian Express has pointed out: That private consumption in April-June this year was lower than four years earlier, i.e. in 2017-18…

If overall consumption has stagnated over four years, it must have declined in the lower-income reaches. This is of course the story of greater inequality, widely debated amidst the turbulence of the last five years, since the demonetisation of November 2016. And what is striking is the government’s tendency to gloss over the subject when discussing macro-economic numbers. Indeed, the government’s chief economic advisor has gone so far as to deny that the economic recovery is K-shaped, i.e. the better off are getting even more well off, while the poor have got destitute.”

Private consumption is the biggest engine of India’s GDP growth, the one the country needs to see whirring away if it is to hope for a return to the +7% growth years of the 2000s.

What is often missed – or unmentioned – in much of the discussion around this key aspect of the economy is how it was trending even before Covid hit. Weak household consumption was one of the reasons that India’s GDP growth had fallen to a dismal 4.5% in July-September 2019, before the pandemic hit. Some were even referring to an “unaddressed demand crisis.”

Somesh Jha reported on government data pointing to consumer spending falling for the first time in more than four decades in 2017-18, likely reflecting “an increasing prevalence of poverty in the country” and a “shortage of demand.” At the time, the government decided not to release the report because of its ‘adverse’ findings.

Despite this, most of the government’s moves – both prior to the Covid crisis and since – have focused on the supply side of the problem: Corporate tax cuts, production-linked incentives, a massive amount of credit.

This has meant that, while markets are flying and companies in the formal sector seem to be getting back on their feet, household savings have fallen and the second wave has shaken even more the confidence that demand will perk up in the future.

As Mahesh Vyas of the Centre for Monitoring Indian Economy explains,

“Consumer sentiments are turning out to be very sticky at the low levels they fell to after the lockdown was imposed in April 2020. Most economic indices have bounced back to the pre-lockdown levels or close to those levels. But, consumer sentiments refuse to spring back. The lockdowns seem to have delivered a knock-out punch here…

Average household incomes had fallen by 14.9 per cent in nominal terms during 2020-21. In real terms, after adjusting for the over 6 per cent inflation in the year, the real fall in average household incomes was a hefty 20 per cent…

In the last normal year, 2019-20, only 9.3 per cent of the households expected their incomes to worsen in the next 12 months. The “next 12 months” turned out to be much worse than their worst expectations. The lasting impact of that experience is evident in 2021-22.”

With government spending currently dragging the economy down, the government still focused on supply-side measures and the ‘demand crisis’ unlikely to go away, what paths does the economy have for it to actually approach the recovery that it needs, never mind the shape?

See also

Roshan Kishore on the economy’s two paths to recovery.

Mahesh Vyas speaks to Karan Thapar about consumption and household incomes.

Linking Out

Vijayta Lalwani on why the perpetrators of anti-Muslim assaults are broadcasting their own crimes.

Arunabh Saikia reports: Jat farmers gather for another protest in western UP – but they haven’t closed the door on BJP.

Ipsita Chakravarty & Safwat Zargar look back at the career of SAS Geelani, the Kashmiri separatist leader who died last week.

The RSS’ in-house newspaper decided to attack Infosys, one of India’s biggest companies, as ‘destabilising the Indian economy’ and operating with anti-nationals, because of its failure to provide tax filing services adequately.

In this CSE working paper (cse.azimpremjiuniversity.edu.in/publications/f…), I propose an alternative policy framework that can meet 3 targets together- stabilization of income growth rate of labour, output growth rate and debt-GDP ratio despite interest rate rigidity. Abstract below in thread.1/10 New #CSEWorkingPaper by @DasguptaZico: Financing Fiscal Support under Alternative Policy Frameworks https://t.co/BsoFHbX1cZ Objective of paper to examine policy frameworks to achieve three targets- stabilizing growth of labour income, output growth rate and debt-GDP ratio.

In this CSE working paper (cse.azimpremjiuniversity.edu.in/publications/f…), I propose an alternative policy framework that can meet 3 targets together- stabilization of income growth rate of labour, output growth rate and debt-GDP ratio despite interest rate rigidity. Abstract below in thread.1/10 New #CSEWorkingPaper by @DasguptaZico: Financing Fiscal Support under Alternative Policy Frameworks https://t.co/BsoFHbX1cZ Objective of paper to examine policy frameworks to achieve three targets- stabilizing growth of labour income, output growth rate and debt-GDP ratio. CSE- Azim Premji University @working_india

CSE- Azim Premji University @working_india

Can’t make this up

India’s roads have lots of problems, but…

Thanks for reading the Political Fix. Send feedback to rohan@scroll.in.

Support our journalism by contributing to Scroll Ground Reporting Fund. We welcome your comments at letters@scroll.in.