The Political Fix part 1: Does India have the money and means to deliver a Basic Income to poor citizens?

A weekly newsletter on Indian policy and politics from Scroll.in.

Welcome to the Political Fix by Rohan Venkataramakrishnan, a weekly newsletter on Indian politics and policy. To get it in your inbox every Monday, sign up here.

If you want journalism with spine not spin, consider supporting us either by subscribing to Scroll+ or contributing to the Scroll.in Reporting Fund.

The Big Story: Basic

If India is to climb its way out of the Covid-19 hole, it will need big-picture thinking.

The country may not yet be as badly hit by the coronavirus crisis in terms of infections and deaths as other large nations. Yet the cost of social distancing and the national lockdown which will stretch five and a half weeks at least is bound to be massive.

According to the International Labour Organisation, the economic shock caused by the shutdown threatens to push 400 million people into poverty. The Centre for Monitoring Indian Economy has described the fall in employment in the last week of March as “particularly steep – almost spectacular”.

Looking at the data, Appu Esthose Suresh, Senior Fellow of the Atlantic Fellows for Social and Economic Equity at the London School for Economics, concluded that “in real terms, is that the poorest 500 million Indians would be out of cash reserves completely by April 15 and another 500 million will be left with just half their reserves”.

How can India ensure that its resources are channeled to those who have been hardest hit?

One idea that has floated around India’s policy thinking spaces for a few years is a basic income for all citizens.

In 2017, the Economic Survey, an annual document prepared by the Chief Economic Adviser, suggested a universal income for all Indians. The Congress made a minimum income scheme for the poor the centrepiece of its electoral campaign in 2020, which we looked at closely on this newsletter last year.

Now, governments around the world are beginning to consider giving cash handouts directly to their citizens as a way of addressing the economic pain caused by the Covid-19 crisis.

It has also been recommended, in various forms, by analysts and observers from across the ideological spectrum:

Former Reserve Bank of India Governor Raghuram Rajan called for a temporary income transfer scheme for the poor.

Swarajya’s R Jagannathan called for a Universal Basic Income Support scheme.

The Congress’ Praveen Chakravarty prescribed a basic income of Rs 3,000 a month for six months to the bottom half of Indian households.

Prime Minister Narendra Modi’s former Chief Economic Adviser Arvind Subramanian has called for a monthly income of Rs 2,000 to 75% of Indian households.

But does India have the capability to institute a basic income scheme, even if not a universal one?

There are two key questions that need to be answered before India can contemplate such a move.

Where will the money come from? Answering this would provide some direction on how big of an income payout policymakers can contemplate, and how long it can be in place.

How will it be delivered? Only if the delivery mechanisms are carefully scrutinised can India figure out which sections of the population can be targeted.

Where will the money come from?

The Indian economy was struggling even before the Covid-19 crisis hit. In December, the Reserve Bank of India cut Gross Domestic Product growth expectations for the year from its original 7% all the way down to 5%. The central bank has since admitted that even those projections were off the mark.

Financial Year 2019-2020 was also set to be a truly challenging year for the government, with the policymakers staring at the biggest tax shortfall in a decade – before coronavirus forced the economy to shut down.

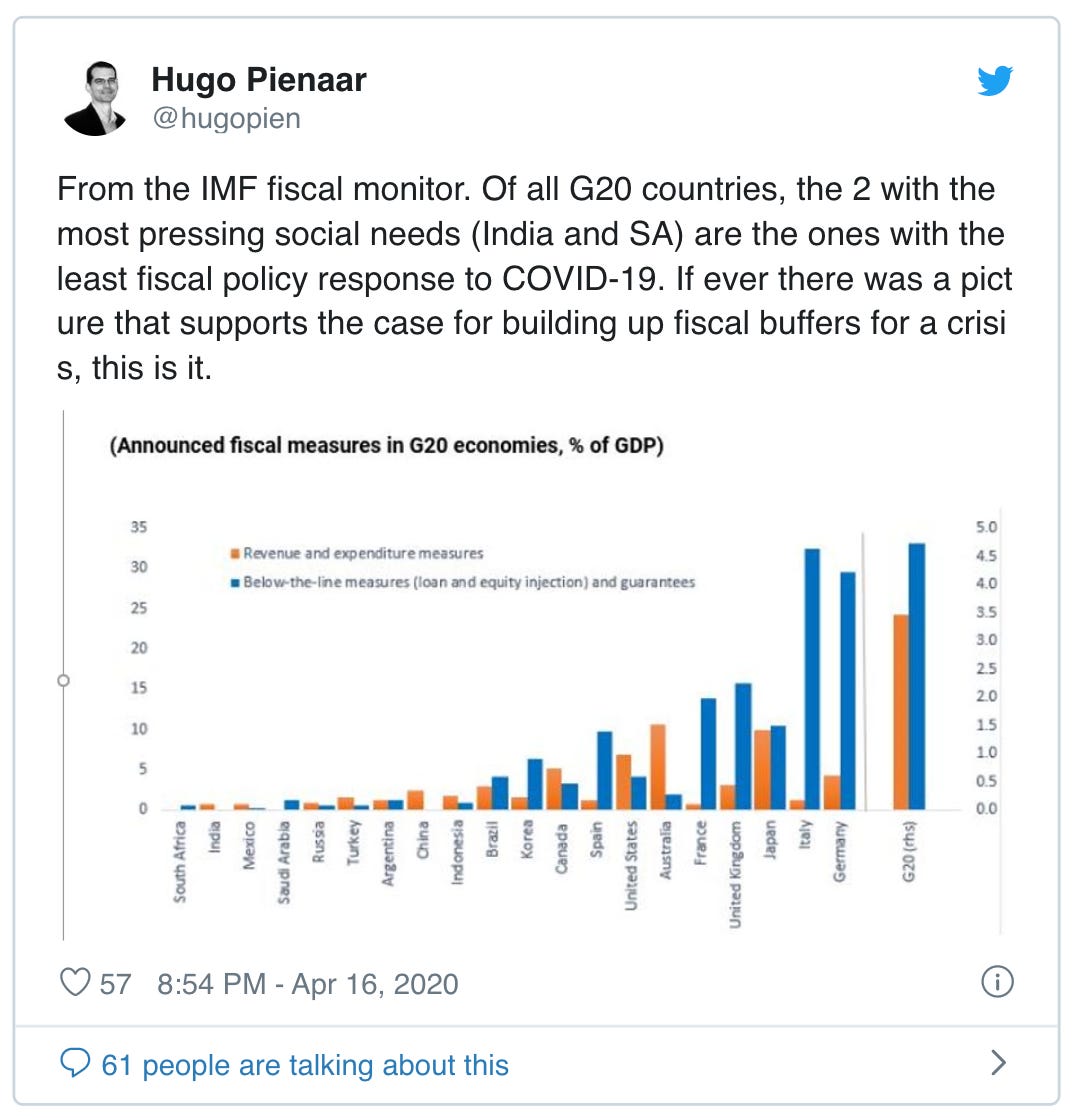

Yet most observers have argued that in these extraordinary circumstances, the poor state of India’s fiscal numbers should not stand in the way of government expenditure aimed at helping citizens out of the coronavirus crisis.

As Rathin Roy, a former member of the Prime Minister’s Economic Advisory Council has argued, “We have to shift the way we think about the economy from a business-as-usual scenario to a wartime economy... A wartime economy involves investing in winning a war because if you do not win the war, there is no economy to invest in.”

In other words, if India believes that a basic income is the need of the hour, then it should be able to find the money for it.

“A medical crisis has forced governments across the world to impose lockdowns on economic activity, deliberately causing the great misery of recessions to check the virus’ spread and save millions of lives,” wrote economist SA Aiyar. “When the government itself creates a recession – albeit for good medical reasons – it may reduce GDP by 3%. Its relief package should be at least the same size. Forget orthodox fiscal policy. India, like the US, must bust all fiscal records.”

There have been numerous suggestions for how India can do this.

The Finance Ministry will have to tear up the expenditure plan it proposed in the Budget, which was tabled in Parliament at the beginning of February.

A Mint evaluation found that if allocations are havled to 11 departments, such as the election commission, department of posts, department of defence (revenue) and so on, it could free up funds equivalent to about 1% of India’s GDP. This, however, will not cover the amount needed for even the most minimal basic income or income support plan if it is to include at least half of Indian households.

The recommendation from Praveen Chakravarty of the Congress for example, suggests Rs 3,000 per month for the next six months to “the 12 crore, bottom half of all Indian households”. Chakravarty says this will cost Rs 2.2 lakh crore, about 1.3% of GDP and will reach 600 million beneficiaries. The London School of Economics’ Suresh calls for transferring up to Rs 2.5 lakh crore in cash up till the 87th percentile of the population.

India has several options to obtains funds for programmes of such a size.

In a series of op-eds published in the Business Standard, former Chief Economic Adviser Arvind Subramanian and Johns Hopkins University professor Devesh Kapur go much further than suggesting a simple juggling of budget numbers. They lay out a number of different routes to raise the money, from foreign borrowing to public financing by issuing government bonds to having the Reserve Bank “print money.”

For a basic income scheme specifically, however, Subramanian and Kapur argue that India should go much more actively towards an approach that drives home redistributive equality: by relying on a wealth tax of 1.5% for billionaires, a tax on properties worth more than Rs 1 crore, reinstating higher tax thresholds and eliminating some “middle class subsidies”.

“For India, the current crisis requires collective solidarity in the form of resources to be provided by the wealthy and privileged to aid those devastated by the crisis,” the authors write, saying that a fund must be created that is explicitly earmarked to pay for basic income.

“This fund could be financed on a permanent basis from wealth and property taxes (on the direct tax side) and the additional revenues from elimination of middle class exemptions and subsidies and restoring previous income tax thresholds. Together, India could dedicate around 2-2.5 per cent of GDP from these sources in the long run. Today, that would provide a monthly income of about Rs 2,000 to 75 per cent of India’s 250 million households.”

Here it is pertinent to note that there are voices advocating caution. Former Reserve Bank of India Governor Urjit Patel making the point that the crisis will not disappear in a matter of months and the financial challenges will continue to come in waves, so the government should keep “some policy gun powder dry.”

How will it be delivered?

Targeting the needy has been a long-standing problem in India.

Research for example shows that outdated population figures have led to more than 100 million people excluded from India’s public distribution system, through which it delivers food to the masses.

Giving out cash, especially if it has to be done digitally, is even more complicated.

At the start of India’s lockdown, the government announced some cash handouts to alleviate economic distress. Among these was an amount of Rs 500 per month to women through their Jan Dhan accounts, under a programme launched by the current Union government aimed at financial inclusion.

Finance Minister Nirmala Sitharaman at her press conference announcing this package looked taken aback at one reporter’s question about how the government would address the poor who are not covered by the Jan Dhan Yojana.

A set of researchers from Yale and the University of Southern California compared Jan Dhan Yojana account details to poverty data and concluded that as many as 53% of poor women in India, more than 170 million, would not get the relatively tiny amount of Rs 500 that the government had promised as support through the lockdown.

“Thus, many of the poor will remain vulnerable despite the attempt to provide relief through PMJDY-linked cash transfers,” the researchers conclude. “Among those who do receive a transfer, access may still present a challenge for some. Twenty-six percent of poor women live more than 5 km away from their nearest banking point.”

Some have suggested that India can overcome these giant exclusion errors by finding ways to deliver cash handouts through digital payments, meaning all an individual would need would be a smartphone with internet connectivity and, presumably, government identification like Aadhaar.

However, despite the explosive growth in mobile phone usage and internet connectivity in India over the last decade, neither indicator is even close to universal coverage. The 2017 Global Financial Index, despite acknowledging the expansion in India’s bank account numbers, revealed that percentage of those who are comfortable using their phones or cards for banking is tiny.

The other option for banking coverage – using “banking correspondents” or agents of banks authorised to offer services – would be extremely arbitrary right now, considering the lockdown as well as fears of infection.

This brings up a major problem: even if India managed to get the resources to put money in the accounts of all those who need it, they might not be able to use digital means to deliver that cash to those who need support the most.

The state of Odisha, where access to phones, internet and banking is relatively lower, has in the past used a more old-school approach: simply giving cash in hand. While corruption would be a danger of this approach, the state has designed its disbursement approach to minimise the chances of beneficiaries being underpaid.

Three renowned economists from India – Nobel laureates Amartya Sen and Abhijit Banerjee and former Reserve Bank Governor Raghuram Rajan – wrote a piece recently calling on the government not to skimp on spending for the needy.

The piece argues that the government should universalise rations (a subject I wrote about also this week), and look to the rolls of beneficiaries of other schemes, such as the employment guarantee scheme, a nationalised health insurance scheme and an LPG distribution scheme, as indicators on which families should be targeted.

They also point to recent research that forcefully makes the argument that cash transfers are not by themselves a panacea. If India is to ensure that millions do not fall by the wayside because of the Great Lockdown, as the International Monetary Fund is calling it now, it will have to ensure that it delivers cash as well as in-kind transfers like food directly to the needy.

Successfully doing this while also working on preventing the spread of Covid-19 should be the country’s biggest priority over the next few months, and will be the biggest test of its state capacity yet.

Flotsam & Jetsam

India is supposed to re-open in phases starting Monday in the districts unaffected by Covid-19, but it’s unclear if the rules in place by some states will actually lead to industries starting work. Uttar Pradesh Chief Minister Adityanath’s decision to bring back some students from Kota, Rajasthan by bus, despite the lockdown, is causing political ripples elsewhere. Congress’ Rahul Gandhi made a noise about Chinese companies being able to grab cheap Indian stocks, while his party complained about e-commerce getting a leg up over traditional retail, and soon after, the government halted automatic FDI for neighbouring countries and did a u-turn on allowing e-commerce to deliver non-essential goods.

What are your proposals? The writer of the story is fully aware that loot of Banks was freely allowed and named the loot as NPA